FinTech Companies Thrive and Innovate with ChaosSearch

Part One: Accelerating Application Development and Streamlining CloudOps

ChaosSearch addresses critical pain points and overcomes core operational challenges for FinTech companies, allowing them to accelerate application development and streamline their operations in the cloud.

The ChaosSearch cloud data platform delivers search and relational analytics at scale directly in Amazon S3, with no data movement, no ETL process, and zero administrative overhead. With ChaosSearch, FinTech companies can capture, analyze, and retain more of their data with massive reductions in time, cost, and complexity.

This is Part One of a two-part blog series exploring how ChaosSearch helps FinTech companies thrive and innovate in an increasingly competitive global market. In this blog, you’ll learn how using ChaosSearch for log analytics helps FinTech companies accelerate application development and streamline operations in the cloud.

READ: Smarter Log Management in Fintech

A Quick Refresher: Defining FinTech

Financial technology (Fintech) companies create technologies and software applications that automate or enhance financial services. There are more than 26,000 Fintech companies operating worldwide, with offerings across multiple product categories, including:

- Payments (e.g. Stripe, Brex, Remitly, etc.)

- Lending (e.g. Klarna, Affirm, Social Finance, etc.)

- Personal Finance (e.g. Nerdwallet, Betterment, etc.)

- Retail Investments (e.g. Robinhood, eToro, etc.)

- Real Estate (e.g. Zillow, Opendoor, etc.)

- eCommerce (e.g. Shopify, Signifyd, Bolt Financial, etc.)

FinTechs compete with traditional financial service providers by delivering innovative products that expand access to financial services in underserved market segments (e.g. Brex provides banking and specialized credit products for start-ups and small businesses), or provides better service (e.g. Robinhood makes it easier for retail investors to participate in public equity markets).

FinTech Companies Depend on Log Analytics

Modern FinTech companies are cloud-native, data-driven organizations that depend on log data for a number of use cases, from troubleshooting cloud services and infrastructure to security operations and threat hunting.

Analyzing log data provides FinTech companies with critical insights into the availability, operational status, performance, and security of cloud-based applications and services:

- Logs from AWS native services like Elastic Load Balancer (ELB) and Amazon CloudTrail are the main source of information for cloud operations, security, and compliance.

- Logs from microservices like Amazon Lambda and Amazon EKS help FinTech development teams manage the underlying infrastructure for their microservices and containerized apps.

- Logs from customer-facing applications and services provide critical insights into user behavior that help FinTech developers, marketers, and product teams identify opportunities for improvement and accelerate product innovation.

- Logs from third-party solutions like CDN providers and web server applications allow Fintechs to monitor the availability, security, and performance of these essential services.

How Do FinTech Companies Do Log Analytics Today?

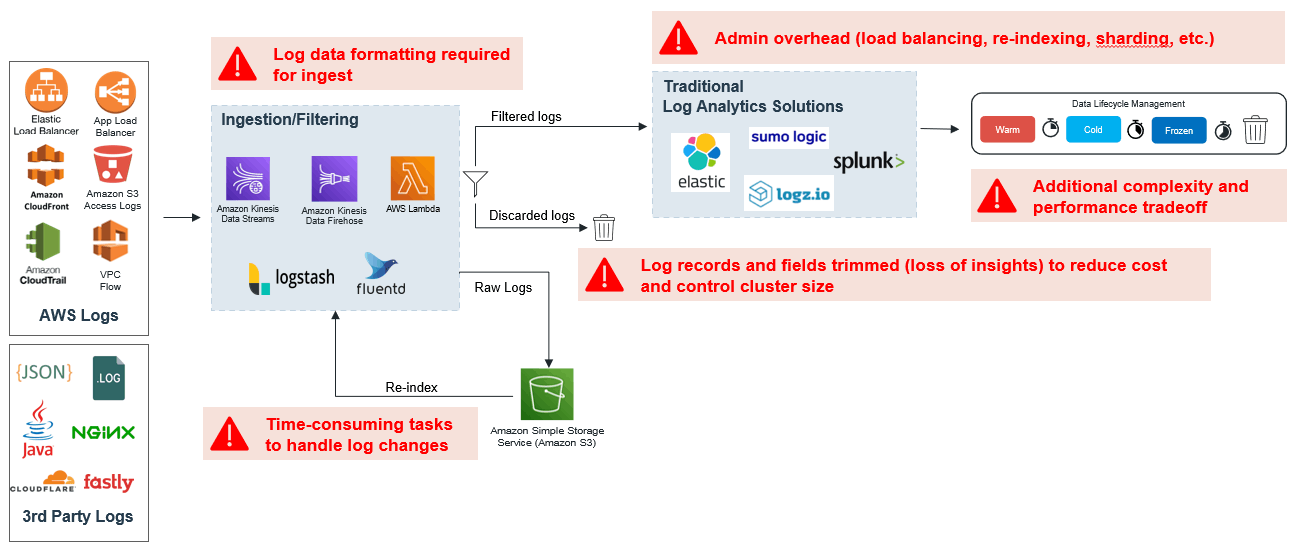

FinTech companies today build complex data pipelines to aggregate and ingest log data from cloud-based applications and services, normalize and transform those logs, and move them to traditional log analytics solutions like Elasticsearch, Splunk, or Sumo Logic.

Log shippers like logstash and fluentd, along with data streaming tools like Amazon Kinesis, are used to aggregate and ingest logs from AWS native services and 3rd-party applications. Raw log data is also stored in Amazon S3 cloud object storage for disaster recovery and compliance purposes.

Traditional Log Analytics Solutions Fall Short for FinTech Companies

Legacy log analytics solutions (e.g. Elasticsearch, Splunk, etc.) work well for small to medium scale deployments, but when log ingestion volume start hitting thresholds around terabytes (TB) per day (commonplace for modern cloud-native organizations) the cost and complexity of managing these solutions grows exponentially - especially when increased log volume is tied to long data retention requirements.

To complicate things even further, successful Fintechs usually experience explosive growth (in both customers and log data), making it even harder for legacy solutions which can’t scale seamlessly to meet the elevated demand.

As a result, growing FinTechs who depend on these solutions will eventually face complexity and performance trade-offs that lead to loss of insights and prevent them from making full use of their log data.

Here’s why these legacy log analytics solutions fall short for FinTech companies:

Complex Ingestion Layer

Traditional log analytics solutions follow a schema-on-write approach, where a schema must be created for log data before it can be indexed for analytics.

In practice, this means that FinTech engineers and data scientists must spend time manually creating schema for any log data they wish to analyze, and configuring the ingestion layer to transform the logs into the required format. The dynamic nature of logs, especially application logs, makes these tasks increasingly time-consuming at scale.

Back Pressure on Development

With legacy log analytics solutions, application updates are disruptive to downstream data pipelines.

When developers make changes to the application code that impact logging outputs, data pipelines can break down and must be manually re-configured by data engineers to capture the new logs.

This creates a back pressure on developers (who want to innovate quickly and push new updates) from data engineers and log consumers (who want to make sure that logging systems don’t break) which slows and stifles innovation.

And, when log data consumers (SREs, DevOps, SecOps, etc.) request schema changes to accommodate new data analysis requirements, data engineers can’t update or modify the schema without re-indexing, a process that becomes increasingly painful and costly at scale.

High Administrative Overhead

Traditional log analytics solutions require constant monitoring and tuning, especially at scale.

As log indices grow in size, even so-called “managed solutions” leave customers responsible for several critical, but time-consuming tasks like indexing, sharding, and performance optimization.

Managing large-size clusters also requires highly skilled engineers and developers, the exact people you want focused on data analysis and other revenue-generating business activities - not babysitting the system itself.

High Data Retention Costs

Log data storage costs can grow exponentially as FinTech companies scale and mature. Log data is often duplicated between cloud object storage (Amazon S3) and the company’s log analytics solution for backup and re-indexing purposes, which significantly impacts costs when FinTechs are ingesting logs at terabyte or petabyte scale.

Loss of Insights

To help control data retention costs, FinTech companies are often forced to place restrictions on which logs will be analyzed, trim fields from their logs, and shorten the data retention window in their log analytics solution from the standard 15- or 30-day window to seven days or less.

When FinTech companies discard logs that can’t be analyzed due to the time, cost, and/or complexity involved, the result is a loss of insights that impacts multiple log analytics use cases, from long-term application trending to root cause analysis.

Complexity and Performance Trade-offs

Some traditional log analytics solutions offer storage tiering capabilities that help reduce data retention costs. This not only increases management complexity, it also creates a performance trade-off: data in tiered storage must be recovered before it can be accessed or queried, a process that can take hours when FinTech companies need answers right away, like during a security incident where consequences are still unfolding.

READ: Beyond Observability: The Hidden Value of Log Analytics

Log Analytics Challenges for FinTech Companies

The shortcomings of legacy log analytics solutions mean that FinTech companies face distinct and predictable log analytics challenges as they scale operations and experience big data growth.

Let’s focus on just two of those challenges for now: streamlining CloudOps, and accelerating application development.

FinTech Challenge #1: Streamlining Cloud Operations

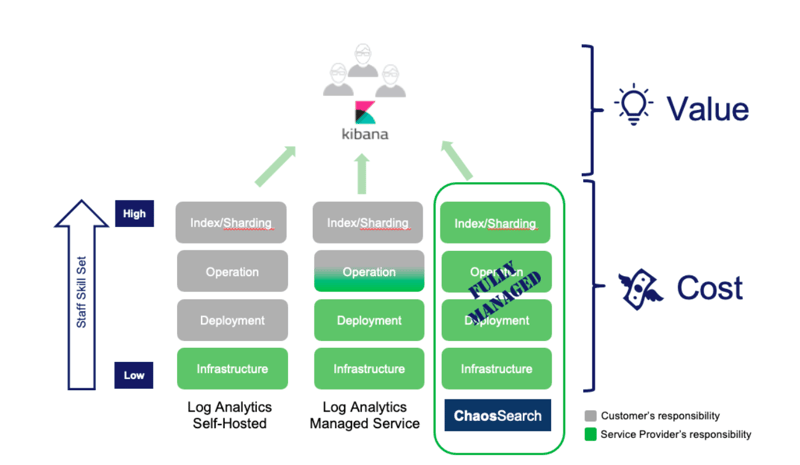

Managing log analytics solutions and the related cloud infrastructure is increasingly complex and time-consuming at scale. Building and managing data pipelines, configuring sharding, load balancing, and re-indexing data all contribute to the high administrative overhead that plagues legacy log analytics tools.

FinTech companies drive revenue and user growth by developing and releasing new products and features - not by managing cloud infrastructure.

This simple truth means that there’s a genuine business need for FinTech companies to offload the administrative overhead of legacy log analytics tools without breaking the bank, which means investing in SaaS solutions that are cost-effective at scale and don’t lead to data lock-in.

FinTech Challenge #2: Accelerating Application Development

The commodification of financial tech is intensifying competition in the FinTech marketplace, making fast and agile product differentiation critical for those who hope to stay relevant, increase their market share, and compete successfully in the long term.

In the world of software development, releasing a new feature or capability usually means making changes to the logs. Popular log formats like JSON are very flexible to easily accommodate application changes and new log information.

However, the downstream log analytics pipelines required by traditional log analytics solutions are unable to dynamically adapt to the changes and risk breaking if they are not re-configured or prepared in advance. In some cases, this requires a full re-indexing of the data in addition to the regular planning and testing.

This can create a counter-productive dynamic where developers feel pressured to slow their development activities, thereby avoiding disruption to logging activities that ensure the availability, reliability, performance, and security of the application.

Relieving this pressure and accelerating application development to enable faster releases is now a mission-critical challenge for FinTech companies seeking a competitive edge.

JSON FLEX® is a scalable analytics solution that enables granular application insights while taking the pain out of indexing and querying complex JSON files. It’s perfect for FinTech app development. Read about JSON FLEX®.

ChaosSearch Helps FinTechs Streamline CloudOps and Drive Innovation

The ChaosSearch cloud data platform transforms FinTechs’ cloud object storage (Amazon S3) into a hot data lake for search and relational analytics.

Analyzing logs directly in Amazon S3 (with no data movement and no ETL process) means FinTechs can take advantage of cost-effective cloud object storage, and they won’t need to replicate data between S3 buckets and an external log analytics platform.

Unlike legacy tools, the ChaosSearch log analytics solution follows a schema-on-read approach that allows FinTech companies to store and index log data in its raw form, then apply transformations and schema at query-time.

READ: How to Calculate Log Analytics ROI

Flexible Logging with No Lost Insights

ChaosSearch incorporates a proprietary indexing technology called Chaos Index®, a new data representation that delivers 10-20x compression with no data loss and significantly reduces the cost to store, index, and query log data.

With the revolutionary power of Chaos Index®, ChaosSearch allows developers to capture and retain any and all logs for analytics purposes with no data retention trade-offs and no lost insights.

Focus Your Team on Driving Business Value

For FinTech companies using legacy log analytics tools, routine tasks like building data pipelines, configuring the ETL process, managing and provisioning Elasticsearch clusters, load balancing, and sharding large indices consume hours of time every week.

ChaosSearch is delivered as a true SaaS with zero administrative overhead, so highly paid engineers and data professionals can spend less time managing logs and more time developing new features and applications that drive revenue.

Log Analytics for FinTech: Ready for a Solution that Scales with You?

FinTech start-ups targeting explosive growth need a log analytics solution that’s ready to scale quickly and seamlessly with demand.

Unlike legacy log analytics tools that have proven to be unstable, inefficient, or too expensive to operate at scale, ChaosSearch allows FinTech companies to store and analyze logs directly in Amazon S3 cloud object storage - taking advantage of its durability, scalability, and cost-effective characteristics.

Ready to learn more?

Stay tuned for Part Two of this blog series, where you’ll discover how ChaosSearch is helping FinTech companies enhance their cloud security posture and meet data compliance regulations.

Or try our free trial experience - it takes just minutes to start analyzing your log data with ChaosSearch.

Additional Resources

Read the Blog: Leveraging Amazon S3 Cloud Object Storage for Analytics

Watch the Webinar: Make Your Data Lake Deliver - AWSInsider

Check out the Whitepaper: DevOps Forensic Files: Using Log Analytics to Increase Efficiency